Financing a portfolio of solar agrivoltaism and battery storage projects in Italy

This fundraising is a reopening of the NRG Agri-Sun & Storage campaign under a different structure. After analysing the fundraising, we found that many investors would have preferred to make this investment through a French structure.

We have therefore decided to reopen this fundraising, structured as a bond issuance in France. All legal and tax aspects will follow the French regulations applicable to bonds, as for the other projects financed in France.

The NRG Plus Sun & Storage project, developed by the group NRG PLUS , consists of a portfolio of 3 battery energy storage systems (BESS) and 2 solar plants, with a total capacity of 260 MW for the BESS and 87 MW for solar. These projects are located in the Italian regions of Tuscany, Emilia-Romagna, Apulia and Basilicata. All projects have secured land rights and grid connections, facilitating the transition to the ready-to-build state.

The NRG+ PLUS group is seeking to raise a first tranche of 1 million euros, which can be uncapped up to 2 million euros. The funds will support the completion of the development of the portfolio and bring the projects to the ready-to-build state.

The fundraising is in the form of simple bonds under French law, and is structured with an annual interest rate of 9.5%, a 3-year maturity and a final repayment at maturity.

The funds will be mainly used to finance the permitting procedures and to cover the development costs borne by NRG PLUS until the ready-to-build state.

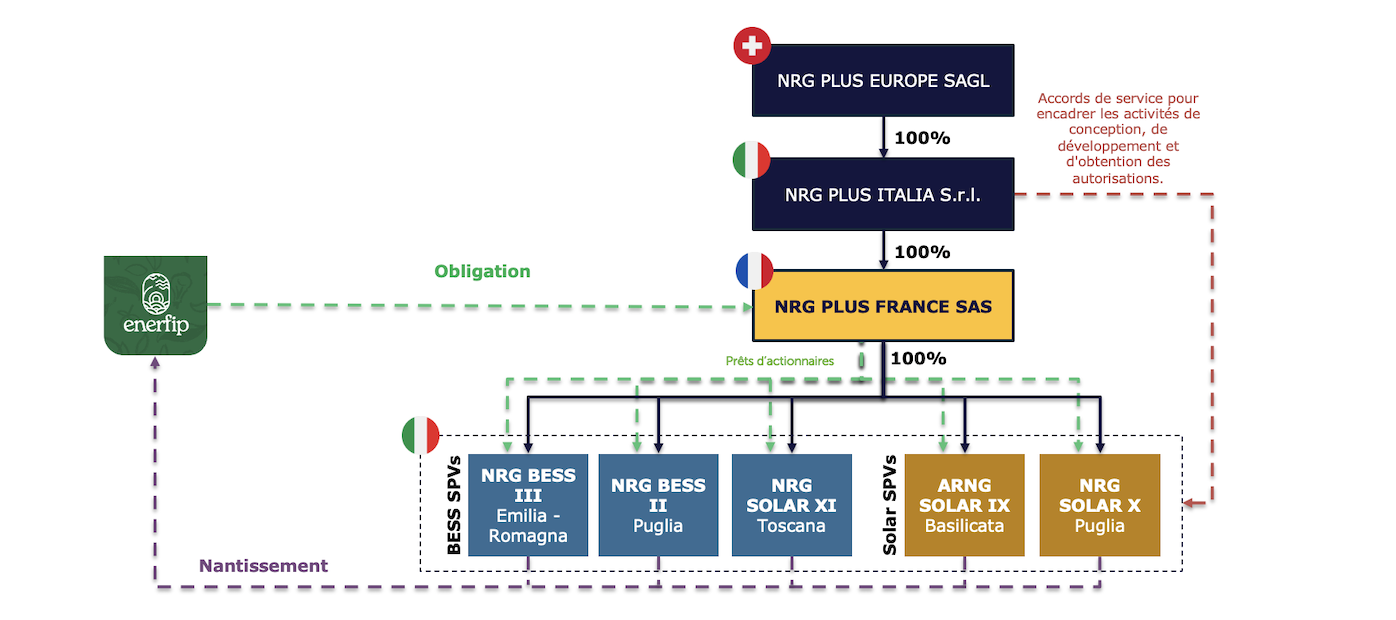

The financing is granted to NRG PLUS FRANCE, which holds 100% of the shares of the SPVs carrying the projects. To secure investors, Enerfip benefits from a pledge on the borrower’s securities, allowing the mobilization of the assets held in case of default. Repayment is expected with the sale of the projects to investors once the project is brought to a more advanced stage of development and the construction permits are obtained. The sale of the projects is expected between late 2027 and early 2028 depending on the projects, with a theoretical forecasted value of the portfolio of around 15 million euros.

L'offerta

Invest in Italy's energy transition with 3 battery storage projects under development and 2 solar projects.

Investment Opportunity

NRG PLUS presents an investment opportunity to finance the development of a diversified portfolio of 5 renewable energy projects located in Italy, including:

- 3 autonomous battery energy storage systems (BESS) with a combined capacity of 260 MW / 2,080 MWh, with a maximum injection duration of 8 hours.

- 2 ground-mounted agrivoltaic photovoltaic plants with a combined capacity of 87 MW.

Offer Conditions and Repayment Strategy

This project will be carried out through the issuance of simple bonds, with a fundraising target of 1 million euros, which can be uncapped up to 2 million euros, over a period of 3 years, with final repayment.

The funds raised will be used to finance:

- Technical development costs including environmental and technical studies.

- Permit costs

- Land costs during development

- Operating costs consisting of accounting, administrative, and incorporation costs

Once the projects reach the ready-to-build stage, the SPVs are intended to be sold once the ready-to-build stage is reached, generating cash flows to repay the loan.

Guarantees

Enerfip benefits from a first-rank pledge on the capital shares of the SPVs, i.e., the companies that hold the rights to the projects.

In case of default, the assets held by the borrower could be liquidated, allowing the recovery of their residual value to enable full or partial repayment to investors.

Specifiche

Fasi di investimento

- Investimento aperto a tutti

Fine della raccolta

Risorse

Simulatore

Simulazione di investimento

NRG Solaire & Stockage - Obligation 9,5%/anno su 3 anni

Simulazione - Tasso: 9,5% / anno per 3 ans

Investimento iniziale:

1.000 €

Rimborsi e interessi:

1.285 €

In 3 rate

| Data | Interessi* | Capitale | Importo |

| 03/09/2026 | 95 € | 0 € | 95 € |

| 03/09/2027 | 95 € | 0 € | 95 € |

| 03/09/2028 | 95 € | 1.000 € | 1.095 € |

| Totale | 285 € | 1.000 € | 1.285 € |

*Interessi lordi prima delle imposte, tutte le spese incluse (vedi tassazione) Il risultato presentato non costituisce una previsione delle future performance dei tuoi investimenti. Ha solo lo scopo di illustrare i meccanismi del tuo investimento nel corso del periodo di investimento. L'andamento del valore del tuo investimento può discostarsi da quanto visualizzato, sia al rialzo che al ribasso. | |||

Il progetto

The Italian energy market

Italy is one of the largest net energy importers in Europe, with approximately 83.7% of its energy consumption in 2022 coming from imports. The country’s electricity mix remains heavily dependent on fossil fuels, which account for the largest share of total electricity production in 2024. For these reasons, Italy is heavily investing in renewable energies to meet its ambitious energy transition goals and reduce its dependence on fossil fuels. In 2024, renewable energies contributed to 39% of total electricity production, illustrating a gradual transition to cleaner energy sources.

Photovoltaic (PV) is one of the key technologies selected for the energy transition, and the country aims to double its PV installations by 2030.

This context, supported by a constantly evolving and maturing regulatory framework, makes Italy a particularly attractive market for energy storage systems (BESS). Terna, the Italian grid operator, has identified BESS as the key technology for stabilizing the grid and integrating more renewables in the country’s energy mix. To support this, it launched few support schemes, including the MACSE Incentive Mechanism, which offers 15-year contracts to standalone BESS installations, with a focus on long-duration systems (4-8h) such as those developed by NRG PLUS.

What will your investment be used for?

As part of this project, NRG PLUS ITALIA S.r.l. is seeking to finance the development of a portfolio of five renewable energy projects in Italy.

The operation will support the development phase of three standalone battery energy storage systems (BESS) with a total capacity of 260 MW / 2,080 MWh, and two ground-mounted photovoltaic plants totaling 87.27 MWp. The projects are located in four key regions of Italy: Tuscany, Emilia-Romagna, Basilicata, and Apulia.

Project locations

Project locations

All land rights and grid connection points have been secured, and authorization procedures are underway. The goal is to bring all assets to a ready-to-build (RtB) status by 2027, allowing their sale to energy producers, infrastructure funds, or institutional investors.

Portfolio in Italy:

Storage](https://s.enerfip.eu/redactor/d7f3a608-de95-4405-af0a-ff49bd7f9ef2.png)

Example: BESS Manciano Project – 60 MW / 480 MWh

Located in Tuscany, this project involves the development of a lithium-ion battery storage system with an 8-hour discharge capacity. It will contribute to stabilizing the Italian energy grid by storing excess renewable energy and releasing it when demand is high.

Land rights are secured, grid connection has been granted (STMG), and the filing of the authorisation process has commenced. The asset is expected to reach RtB status in 2027, with commercial operation scheduled for 2028 after the asset sale and construction.

Promotori del progetto

NRG PLUS is an independent international renewable energy group, specializing in the development of solar photovoltaic systems, onshore wind, and battery energy storage systems (BESS), as well as the construction and operation of renewable energy projects through its sister company Renergeia. Founded in 2019, the group is currently successfully developing over 2 GW of renewable energy projects.

A Competent and Committed Team

The company is led by Pierluigi Borgogna, Founder and CEO, who has over 15 years of international experience in the energy sector in Europe and Latin America. He is supported by Angelo Romano, Director of NRG PLUS ITALIA, an expert in project finance and development.

With a large team of over 100 professionals active in Europe and Latin America, NRG+ brings together expertise in engineering, permits, land acquisition, legal, environmental compliance, and investment structuring.

NRG+ Italia operates under a vertically integrated model, covering the entire value chain, from project development to construction and long-term operations. Its internal subsidiary, Renergeia, provides EPC and O&M services, ensuring cost control and high-quality execution.

NRG+ Italia operates under a vertically integrated model, covering the entire value chain, from project development to construction and long-term operations. Its internal subsidiary, Renergeia, provides EPC and O&M services, ensuring cost control and high-quality execution.

Proven Experience in Delivering and Selling Renewable Energy Assets

NRG+ has developed and sold more than 30 renewable energy projects with a total capacity of over 1.4 GW in Italy, including in Molise, Apulia, Tuscany, Emilia-Romagna, and Basilicata. The company maintains a strong focus on environmental and social responsibility as well as promoting local engagement from the early stages of development.

The company has implemented an integrated and structured approach to project development, covering all critical phases - from initial site prospecting, engineering, and design to the completion of authorization procedures. This development process is the result of years of experience, internal capacity building, and robust collaboration models. NRG+ has invested in building a team and system that allows them to manage the entire value chain in-house - site prospecting, permits, network management, design, and project management.

This approach ensures efficiency, consistency, and control over the pipeline. It also provides transparency and reliability to partners, as all phases are traceable, documented, and led by professionals with in-depth expertise in the renewable energy sector in Italy.

A Long-Term Vision for the Energy Transition

With a growing presence in Africa and Asia, NRG+ aims to become a key player in the global energy transition. The company focuses on developing high-impact, sustainable, and investment-ready projects that support the transition to a low-carbon economy.

Analisi

Panoramica dei rischi

Rischio di controparte

Rischio di inadempimento di pagamento della controparte che metterebbe a rischio le entrate del progetto

Mezzi di mitigazione

Au stade intermédiaire de développement des projets, le développeur préparera une documentation complète de due diligence vendeur à destination des acheteurs potentiels. Le Porteur de Projet commencera également à engager le marché en amont afin d’évaluer l’intérêt et de s’assurer que la qualité des projets répond aux exigences des investisseurs potentiels. Le portefeuille a déjà été valorisé en utilisant des estimations conservatrices pour réduire le risque que les produits ne suffisent pas à rembourser la dette. En cas de défaut, les investisseurs sont protégés par un nantissement portant sur 100 % des SPV. Ce nantissement permet la vente des projets du Porteur de Projet, dont le produit sera utilisé pour rembourser les investisseurs. Enerfip détient également un droit de consentement sur la vente des SPV des projets.

Rischio di sviluppo

Rischio relativo alle autorizzazioni rilasciate alla società e ai terreni e ai ricorsi di terzi contro le autorizzazioni rilasciate.

Mezzi di mitigazione

Ce risque concerne la délivrance des permis, les droits fonciers et les possibles recours de tiers pouvant retarder ou empêcher l’avancement du projet. Pour atténuer ce risque, le Porteur de Projet suit un processus de développement rigoureux incluant une sélection minutieuse des sites, une implication précoce et des échanges continus avec les parties prenantes locales et les autorités. L’équipe est composée d’experts internes qualifiés dans les domaines juridique, technique et environnemental, garantissant une forte capacité d’exécution tout au long de la phase de permis. Un mécanisme de suivi du ratio prêt/valeur (LTV), ainsi qu’un nantissement, sont mis en place pour protéger les rendements des investisseurs en cas de retard ou de sous-performance.

Rischi normativi

Rischio di cambiamenti nelle normative applicabili al settore, che comportino riduzioni di sussidi o nuove imposte con un impatto significativo sui ricavi del progetto

Mezzi di mitigazione

Les réglementations peuvent affecter les délais de développement et les revenus futurs projetés des projets. À ce jour, les discussions réglementaires suggèrent que le cadre réglementaire du stockage sera amélioré et clarifié, notamment concernant les mécanismes de rémunération auxquels les projets pourront prétendre. Par ailleurs, le pays s’est fixé pour objectif de doubler sa capacité photovoltaïque dans les cinq prochaines années. Ces hypothèses, ainsi que les coûts de construction projetés, sont des facteurs clés dans la détermination des prix de vente des projets. Pour atténuer les risques liés aux fluctuations des prix dues à la réglementation, une approche prudente a été adoptée dans l’estimation de la valeur des projets — par exemple en excluant toute subvention future potentielle que les projets pourraient recevoir. Le portefeuille de projets a également été sélectionné afin de maximiser la diversification et ainsi contribuer à réduire ce risque. De plus, le Porteur de Projet effectue une veille réglementaire continue aux niveaux national et régional, garantissant une identification précoce des évolutions légales ou politiques. Cela permet à l’équipe d’adapter de manière proactive les stratégies des projets et de rester en conformité avec l’évolution des exigences du marché.

L’investimento in questo progetto di equity crowdfunding comporta dei rischi, compreso il rischio di perdita totale o parziale del capitale investito. Il tuo investimento non è coperto dai sistemi di garanzia dei depositi istituiti ai sensi della direttiva 2014/49/UE del Parlamento europeo e del Consiglio. Il tuo investimento non è inoltre coperto dai sistemi di indennizzo degli investitori istituiti ai sensi della Direttiva 97/9/CE del Parlamento europeo e del Consiglio. Il rendimento dell’investimento non è garantito. Non si tratta di un prodotto di risparmio e si consiglia di non investire più del 10% del proprio patrimonio netto in progetti di finanziamento partecipativo. Potreste non essere in grado di vendere gli strumenti di investimento quando lo desiderate. Se riuscite a venderli, potreste comunque subire delle perdite.